Ssdi tax calculator

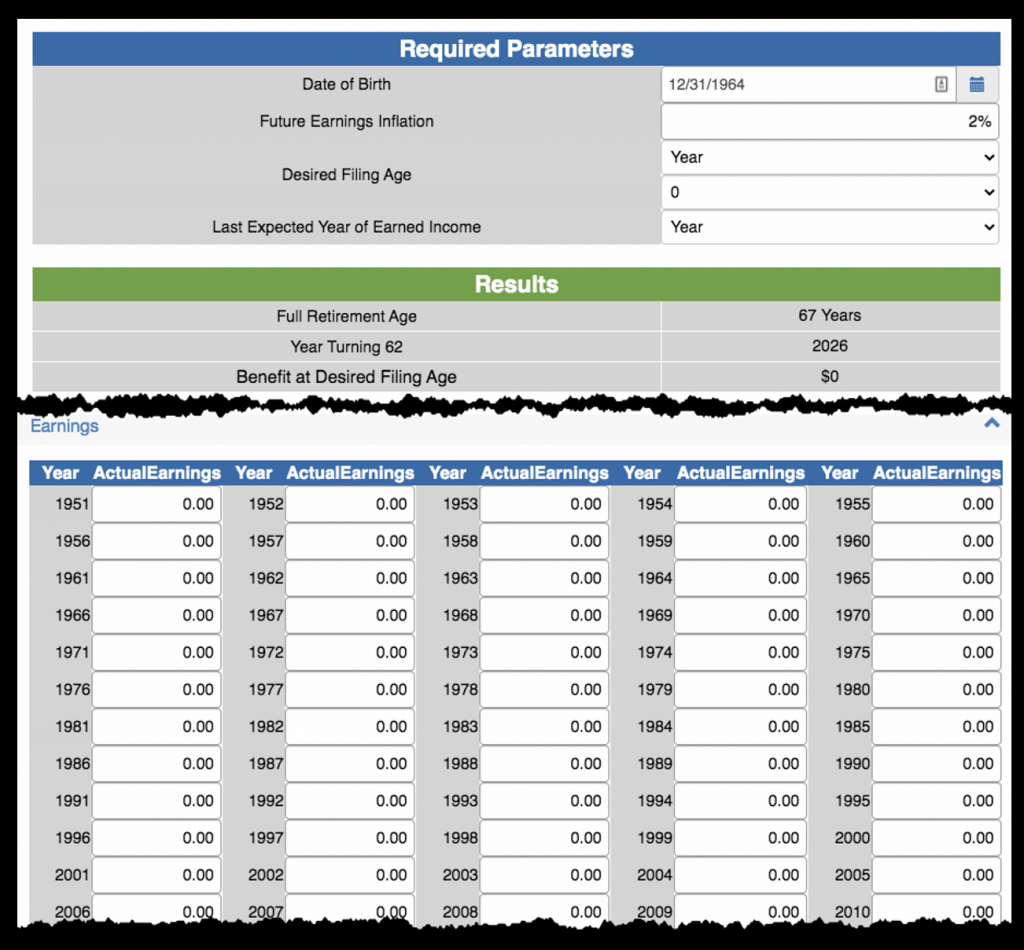

Social Security Quick Calculator Benefit Calculators Frequently Asked Questions Benefit estimates depend on your date of birth and on your earnings history. Federal payroll tax rates for 2022 are.

Payment Differences Between Ssdi And Ssi Disability Benefits Center Ssi Supplemental Security Income Payment

The rates have gone up over time though the rate has been largely unchanged since 1992.

. Thats what this taxable Social Security benefits calculator is designed to do. 25000 if youre single head of household or qualifying widow er 25000 if youre married filing separately and lived apart. As your total income goes up youll pay federal income tax on a portion of the benefits while the rest of your.

Online Benefits Calculator These tools can be accurate but require access to your official earnings record in our database. The base amount for your filing status is. If your income is above that but is below 34000 up to half of.

Did you know that up to 85 of your Social Security Benefits may be subject to income tax. Another change would be adding more funding by applying the Social Security payroll tax on all income above 250000. Estimate Your State and Federal Taxes.

Currently earnings above 147000 arent subject to. Social Security benefits are 100 tax-free when your income is low. While they are all useful there currently isnt a way to help determine the ideal financially speaking age at which.

Find a List of State Tax Calculators and Estimates for Tax Year 2021 and 2022. Social Security tax rate. Multiply that by 12 to get 50328 in maximum annual benefits.

Before you use this. If you have a combined income but are filing as an individual your benefits arent taxed if your benefits are below 25000. This Social Security tax is a scandal hiding in plain sight For couples filing jointly with between 32000 and 44000 you may have to pay income tax on up to 50 of.

If this is the case you may want to consider repositioning some of your other income to minimize. Enter the date of your application Enter the. The simplest way to do that is by creating or logging in to your my.

For 2022 its 4194month for those who retire at age 70 up from 3895month in 2021. You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules. 15 Tax Calculators.

Under the Social Security Disability Insurance program your disability benefits will be based on your average lifetime earnings prior to disabilityThe SSA has a complex formula. Social Security Benefits Tax Calculator Use the calculator below to know the amount if your social security benefit that you must include in the tax return as taxable income. Social Security Disability Benefits Calculator Earnings from your jobs covered by Social Security meaning your FICA taxes are used to determine the amount of monthly SSDI benefits.

Give you an estimate of how much youll have to pay in taxes on your monthly benefits. To use this calculator follow the steps below. Social Security website provides calculators for various purposes.

If thats less than your. Between 25000 and 34000 you may have to pay income tax on. Based on the new data through August The Senior Citizens League estimates the Social Security cost-of-living adjustment or COLA for 2023 could be 87 lower than the 96.

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

Taxable Social Security Calculator

Roth Ira Conversion Calculator Converting An Ira Schwab Roth Ira Conversion Roth Ira Conversion Calculator

Social Security Benefits Tax Calculator

Accounting Finance Ous Royal Academy Switzerland In 2022 Accounting And Finance Financial Management Accounting

Social Security Benefits Tax Calculator

Social Security Benefits Tax Calculator

Resource Taxable Social Security Calculator

Pay Stub Calculator Is Meant For Speeding Up The Process Of Stub Creation Using Online Processing Of Paystubs A Part Of Ef Fast Track Online Processing Paying

Pin On Spreadsheets

Taxable Social Security Benefits Calculator Youtube

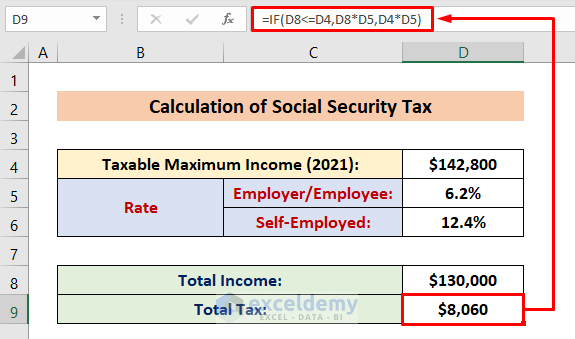

How To Calculate Social Security Tax In Excel Exceldemy

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

A New Report Analyzes How Each State Taxes Or Does Not Tax Social Security Income Social Security Benefits State Tax Social Security

Social Security How To Boost Your Benefit By 800 In 2022 Social Security Benefits Social Security Disability Social Security

Calculators Social Security Intelligence

Precisely When You Become Eligible To Receive Your Full Unreduced Social Security Retirement Benefit Depends Retirement Age Retirement Benefits Age Calculator